The end of the financial year is here, and June will be a month of wrapping up, closing off and preparing for the new year.

If you have any tax obligations to pay, these are now due. Send us an email if you are not sure – outstanding tax debts will begin accumulating general interest charges.

Please reach out to us if you have any questions or if there is anything we can assist with.

Upcoming Dates for June

5 – FY2022 tax debts due for payment

21 – Lodge and pay May BAS (if you lodge monthly)

25 – FBT (Fringe Benefits Tax) Return 2023 Due (if you lodge electronically)*

* Note: The FBT tax year runs from 1st April to 31st March.

30 – End of Financial Year – Prepare to wrap up books for the 2022-23 financial year

30 – Super guarantee contributions must be paid by this date to qualify for a tax deduction in the 2022–23 financial year

We are planning some new service offerings, courses, free training, and events so keep an eye on our newsletters to make sure you are the first to know.

Final Call for FY2022 Tax Returns

If you have not yet completed your 2022 Financial Year taxes, now is the time to focus on getting together all of the required documents so that we can finalise your returns. The ATO are imposing harsh penalties for late lodgements.

Please reach out to us if you are not sure what information we are waiting on. We’d love to get any outstanding returns tidied up and lodged as soon as possible.

ATO Rental Property & Investor Toolkits

The ATO’s Rental Properties Guide provides information on how Australian residents for tax purposes treat rent and rental related income and expenses. It also includes how to treat many rental property assets and items. You can download the guide from here:

https://www.ato.gov.au/Individuals/Tax-return/2022/In-detail/Publications/Rental-properties-2022/

The ATO’s investors toolkit is a resource for anyone earning money from their investments, whether you invest in property, shares or crypto assets. This is available from:

Setting up good record keeping habits for the new financial year

Have you struggled to find records and documents for your tax returns this year? If so, now is a great time to start thinking about how you can keep better records so that next year’s tax return is straightforward and stress-free.

Record keeping is of critically important when it comes to tax returns. Efficient and accurate record keeping ensures that individuals and businesses have the necessary documentation to support their income, deductions, and credits claimed on their tax returns.

Maintaining comprehensive records allows taxpayers to provide the Australian Tax Office (ATO) with the required evidence in the event of an audit or inquiry, minimising potential disputes and penalties.

Proper record keeping helps individuals and businesses accurately report their financial transactions, including income from various sources, expenses, and investments. It also enables them to claim legitimate deductions and credits, resulting in potential tax savings.

In essence, meticulous record keeping provides transparency, credibility, and compliance with tax regulations, ensuring a smooth tax filing process and reducing the risk of costly errors or omissions.

For more information on record keeping from the ATO, visit:

For individuals:

https://www.ato.gov.au/Individuals/Income-deductions-offsets-and-records/Records-you-need-to-keep/

For businesses:

https://www.ato.gov.au/Business/Record-keeping-for-business/

For Self-Managed Super Funds:

Keep an eye out for our July newsletter where we break down what records you should be keeping, for how long and how to audit proof your records to make sure you are ready for any ATO audits.

Queensland Small Business Month

May was Queensland Small Business Month and with the event coming to a close, we hope that you were able to attend or access some of the events held over the month. If not, many of these events were recorded and have been posted on the Business Queensland website here:

https://www.business.qld.gov.au/starting-business/advice-support/support/small-business/qsbm/videos

Topics range from tenant agreements and government contracts to marketing and small business planning, so jump on and see which sessions can help you upskill and stay up to date.

Finish the 2023 Financial Year on a High Note

As the financial year comes to a close, small businesses have a valuable opportunity to end on a high note and set themselves up for success in the coming year. Here are some of the best things you can do to finish the financial year strong:

- Conduct a thorough inventory assessment: Assess your inventory levels, identify slow-moving or obsolete items, and plan for a clearance sale or promotions to sell excess stock. This will not only help free up cash flow but also make room for new products or services.

- Evaluate marketing strategies: Review your marketing efforts and analyse their effectiveness. Identify which strategies brought the best results and consider reallocating resources accordingly. Explore new marketing channels or campaigns to attract more customers.

- Build customer loyalty: Show appreciation to your existing customers through personalized thank-you notes, exclusive offers, or loyalty programs. Encourage them to provide feedback and testimonials to strengthen your brand reputation.

- Tidy up loose ends in your accounting software: Take some time to review the health of your accounting software and data and spend some time reconciling, correcting errors, and bringing everything up to date ahead of the new financial year.

By following these steps, small businesses can end the financial year on a positive note, optimise operations, and set themselves up for growth in the year ahead.

Changes to minimum annual payments for super income streams

The Australian Taxation Office (ATO) has established minimum pension standards for self-managed superannuation funds (SMSFs). These standards outline the minimum amount of money that needs to be paid as a pension to the members of an SMSF who have reached their preservation age (the age at which you can access your superannuation).

During the COVID-19 pandemic, the government reduced superannuation minimum drawdown requirements for account-based pensions and similar products by 50% for the 2019–20, 2020–21, 2021–22 and 2022–23 financial years.

For the 2023–24 financial year, the 50% reduction in the minimum pension drawdown rate will no longer apply.

When you calculate the minimum annual payment after 1 July 2023, you need to make sure that you have not applied the 50% reduction.

Consequences of non-compliance: If you don’t meet the minimum pension standards, your SMSF may face tax implications. The ATO might treat your superannuation income as not being in pension phase, which could result in additional tax liabilities.

For more information, please visit the ATO’s website:

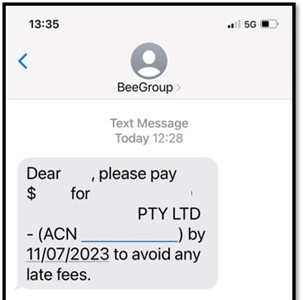

ASIC Annual Statement Reminders for Payment

We will be sending text message reminders when your annual renewal payments are due to ensure that you don’t miss the payment deadline. If these are not paid on time, ASIC imposes hefty fines.

The text message will look like this:

Note: The company name and ACN will be listed and there will be no links for you to click. If you have not received your ASIC Annual Statement or Renewal invoice, please check your junk email folder and if you still cannot locate it, please email us and we will confirm what is outstanding.

There are a lot of scams going around at the moment, so it is always best to check with the sender and never click any links without being certain they are safe.

Financial Year Wrapping Up

This is just a final reminder that we are wrapping up the returns for the 2022 financial year. If you have not lodged yours, please get in touch so that we can let you know what is outstanding and the documents that are required. The ATO will be large fees for all late lodgements so please ensure you have sent us all of your documentation as soon as possible.

It’s also a great time to look ahead at the new financial year and start planning what the next 12 months will look like. Here are five tips to help you get started:

- Review and Set Goals: Assess your previous year’s performance and set realistic goals for the upcoming year. Identify areas for improvement and create a roadmap to achieve your objectives.

- Analyse Finances: Review your financial statements, cash flow, and budgets. Identify any potential cost-saving opportunities, improve pricing strategies, and explore ways to increase revenue.

- Update Systems and Processes: Streamline operations by updating your systems and processes. Automate tasks, implement efficient inventory management, and explore software solutions to enhance productivity.

- Communicate with Your Team: Share your goals and vision with your team. Encourage open communication, delegate responsibilities, and provide training and support to enhance their performance.

- Stay Informed: Keep up with industry trends, changes in regulations, and market dynamics. Stay informed through networking, attending conferences, and continuous learning to adapt and seize new opportunities.

By starting the new financial year on the right foot, you can position your small business for growth and success.

We’re here to help you and will do everything we can to make things easier at tax time and throughout the year. So, if there is something that you need, just let us know.

Need to update your contact details?

Visit our knowledge base for help on how to do this – https://help.thebeegroup.com.au/articles/updating-my-contact-details

Need Help?

The Bee Group Knowledge Base is filled with articles to help you with everyday frequently asked questions:

https://help.thebeegroup.com.au/

Alternatively, you can submit a help request online via our site at:

As always, please reach out to us if you have any questions or queries. We look forward to hearing from you.

Have a great June!

Sheree & the Team at Bee Group Accountants

We have been working hard at improving our systems and building up our team. This means that we are now able to start accepting new clients. If you have someone that you know who is looking for an accountant – please ask them to get in contact with our office via phone, email or through our website.

If there is anything that you think we can improve on too, please be sure to let us know. We are working hard to improve your experience in working with us as well!

We truly appreciate the opportunity to help and welcome any recommendations.