What You Need to Know about Paying Employees

Correctly calculating and paying employees for public holidays is an essential part of leave management and payroll. It is a legal requirement under the Fair Work Act 2009.

Before we start though, here is the general disclaimer, the information contained herein is general advice only and is not personal taxation or legal advice. If you have any questions be sure to get in touch with the FairWork Ombudsman, your local Chamber of Commerce or employer group, or a lawyer who specialises in workplace matters. If you need a referral for any of these services please just reach out to us in the Everything Small Business Group and we can give you more information on practitioners.

The Basics

Employees have the right to be absent from work on a day or part-day that is a public holiday. Employees are protected from adverse action for reasonably refusing to work on a public holiday.

These standards apply to all employees covered by the national workplace system – no matter any award, registered agreement or employment contract.

The right to be away from work on Public Holidays is protected under the National Employment Standards. Here is a link to the legal requirements under the National Employment Standards.

And here’s a link to the dates that are designated as Public Holidays under the Fair Work Act (download PDF).

When you employ someone you are hiring them under an agreement. This could be an Award, enterprise agreement or other registered agreement can set out other rules and entitlements when not working on a public holiday.

What does this mean?

In plain English, it means that that Fair Work Australia has designated a number of days during the year as public holidays.

Public holidays are days of the year that are set out by Government where employees can take the day (or part day) off work.

Whether you’re paid for it or not depends upon your type of pay. If you are full time or part-time you will generally be paid. If you are casual, you will not.

Some public holidays can be different depending upon which State or Territory that you work in, or where your employer is based. If you aren’t sure which ones apply to you then

Queensland: https://www.qld.gov.au/recreation/travel/holidays/public

New South Wales: https://www.industrialrelations.nsw.gov.au/public-holidays/public-holidays-in-nsw/

Can I ask an employee to work on a public holiday, and can they refuse?

Yes – to both questions. There are considered reasonable grounds for an employer requesting an employee to work, or for an employee refusing to work on a public holiday.

To determine what is reasonable, the following must be taken into account:

- the nature of the employer’s workplace (including its operational requirements) and the nature of the work performed by the employee

- the employee’s personal circumstances, including family responsibilities

- whether the employee could reasonably expect that the employer might request work on the public holiday

- whether the employee is entitled to receive overtime payments, penalty rates, or other extra payments

- the type of employment (for example, full-time, part-time, casual or shiftwork)

- the amount of notice in advance of the public holiday given by the employer when making the request

- the amount of notice in advance of the public holiday given by the employee in refusing the request

- any other relevant matter.

- What payment is required for not working on a public holiday?

An employee is not entitled to payment if they do not have ordinary hours of work on the public holiday. But always understand the Award that you are applying because there may be variations to this for Rostered Days Off.

For example, a part-time employee is not entitled to payment if their part-time hours do not include the day of the week on which the public holiday falls.

How much do I have to pay?

With the exception of casual employees, any other employee who would normally work on the day of a public holiday will be paid their base rate of pay.

The base rate of pay is paid for the ordinary hours that they would have worked on the day. If someone would not have normally worked anyway on the day of a public holiday, then they don’t get paid for it.

The base pay rate doesn’t include:

- any incentive-based payments

- bonuses

- loadings

- monetary allowances

- overtime or

- penalty rates.

It should be noted that an employee’s roster can’t be changed to deliberately avoid this payment.

What if a Public Holidays falls during Annual Leave?

If a public holiday falls during a period of paid leave (e.g. annual leave or personal leave), the employee has to be paid for the public holiday if the employee would usually have worked on the day that the public holiday falls. The public holiday will not be deducted from the employee’s paid leave balance. Here are two examples from the Fair Work Ombudsman:

Example 1: Ordinary hours and overtime hours falling on a public holiday

Claire is a full-time employee who usually works overtime on top of her ordinary hours on a Wednesday. She gets an overtime payment for these overtime hours under her Award.

Wednesday 1 January is New Year’s Day, which is a public holiday, so Claire has the day off. Even though Claire doesn’t go to work, she still gets her base pay rate for the ordinary hours she would have normally worked. She is not entitled to payment for the overtime hours.

An employee doesn’t get paid for a public holiday if they don’t normally work on the day that the public holiday falls.

Example 2: No ordinary hours on a public holiday

Ying is a part-time employee. He works Monday to Wednesday each week. This year, Boxing Day falls on a Friday. As Ying’s rostered hours don’t include Fridays, he doesn’t get paid for the Boxing Day public holiday.

An Award, Enterprise Agreement or other Registered Agreement can set out other rules and entitlements when not working on a public holiday.

What if an employee works on a Public Holiday?

There will be circumstances where an employee will work on a public holiday. How they are paid depends upon the nature of their employment. There will generally be a penalty rate loading applied to the ordinary hourly rate of the employee. The following are examples of the penalty loading applied to employee pay where they work on a public holiday under the Clerks Award.

Casual Employees

Casual employees who work on a public holiday must be paid the public holiday penalty rate of 250% of the ordinary hourly base rate of pay for their relevant classification.

Part time and full time employees

Part time and full time employees who work on a public holiday must be paid the public holiday penalty rate of 250% of the ordinary hourly base rate of pay for their relevant classification.

Part time and full time employees must be paid for a minimum of four hours work

The terms of your Award may require that you have other commitments to your employees, especially if there are Rostered Days Off (RDO’s) involved. So it always pays to ensure that you are up to date with the Award or Agreement that you are hiring under.

How do I know what Award I’m employing under?

An Award is a legal document that sets out the terms and conditions of employment for a specific industry or job. They define things like minimum wages, overtime, penalty rates and allowances. The Award will itself contain minimum terms of conditions of employment and these will be in addition to any other legislated minimum terms such as those prescribed in the National Employment Standards (NES).

As a business owner or an employer, you must ensure that any applicable modern Award provisions are adhered to and that they are correctly applied throughout your workplace.

Different Modern Awards may apply depending on the industry in which your business operates, and the job types within your business. You could find that not all of your employees fall under the same Award either. This can make it very difficult to determine modern award coverage for your team. The Government doesn’t make this any easier either. There are 121 modern Awards of general application covering various private sector occupations and industries as at the 15 March 2024.

This means that ensure compliance when managing your employees, you must get to know the Award that is relevant to you and your situation. If you are a private sector employee and you aren’t covered by an Award, then you might also have an enterprise agreement or a registered agreement.

Whatever the circumstances, make sure that you really take the time to read through the Award that you’re hiring under so that you can understand it’s obligations. You don’t want to get caught out because of some misunderstanding about how the rules apply. And this isn’t one and done – there are regular updates to these Awards and it is your responsibility as an employer to be across these requirements.

Reading the Award

There is a lot that goes into reading an Award – once you get the hang of it though it can be relatively straight forward to navigate. We won’t go into depth in how to read an Award here though but will give you a few guidelines on how to navigate it.

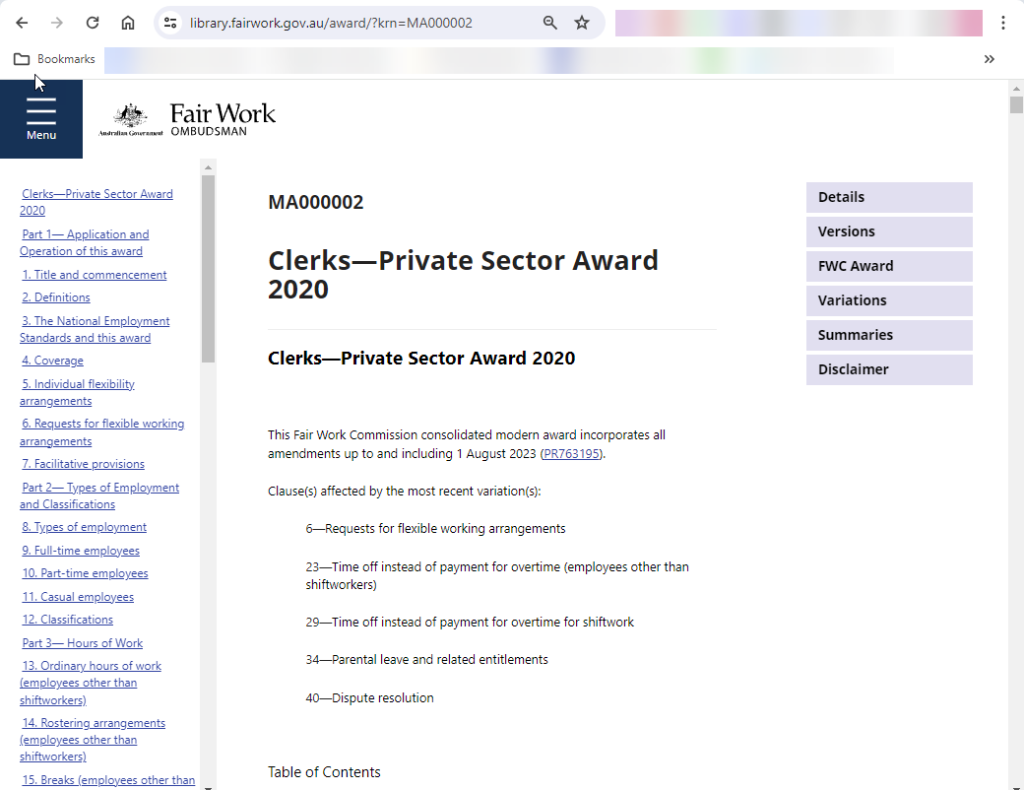

We have found that the Award Viewer is the more complete way to read and review the obligations that you may have as an employer. This is an example using the MA000002 Clerks—Private Sector Award 2020. If you want to take a look at it, here is the link to the Award.

Here is what it looks like when you are first on the page:

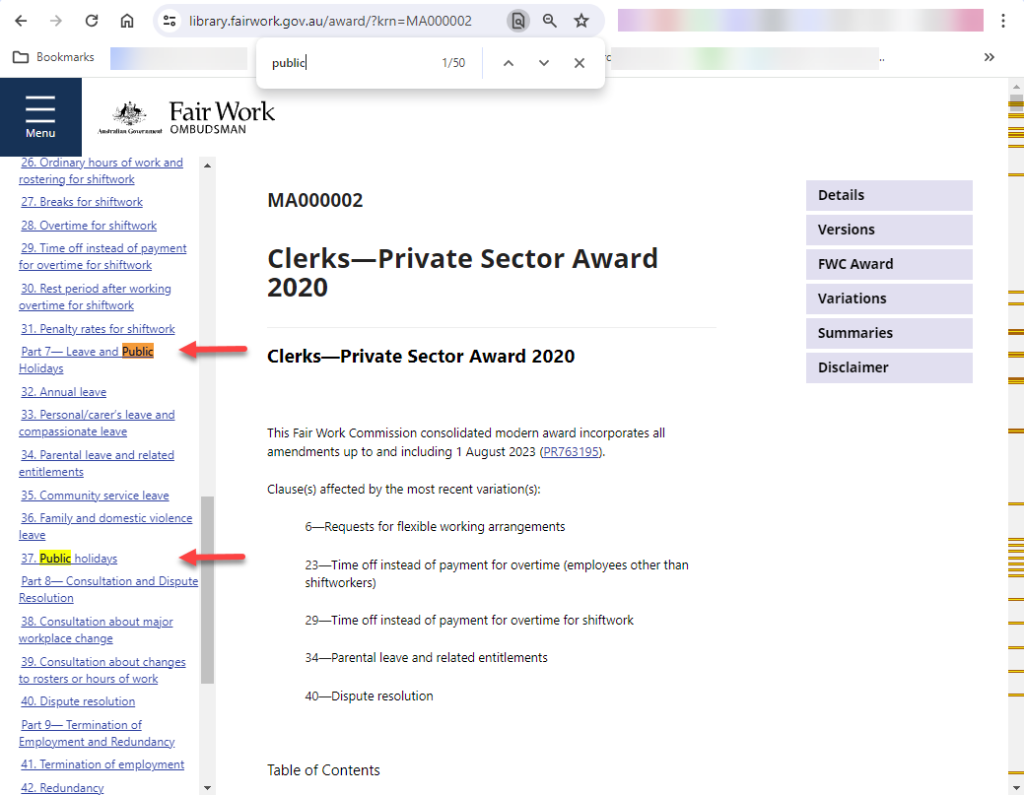

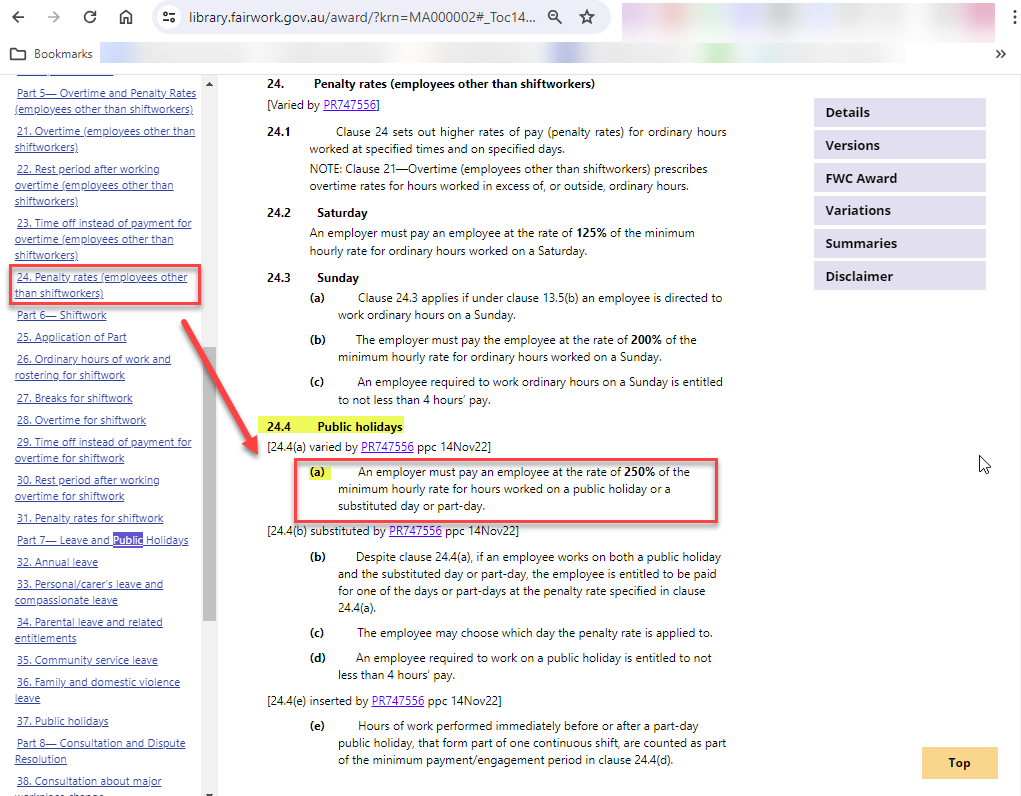

You can search using the Table of Contents down the side by clicking on the link for the relevant area. For public holidays be sure to check for ‘Leave and Public Holidays’ and there will often be a ‘Public Holidays’ specific section. In this image we used <CTRL> + F to find any reference with the term ‘Public’.

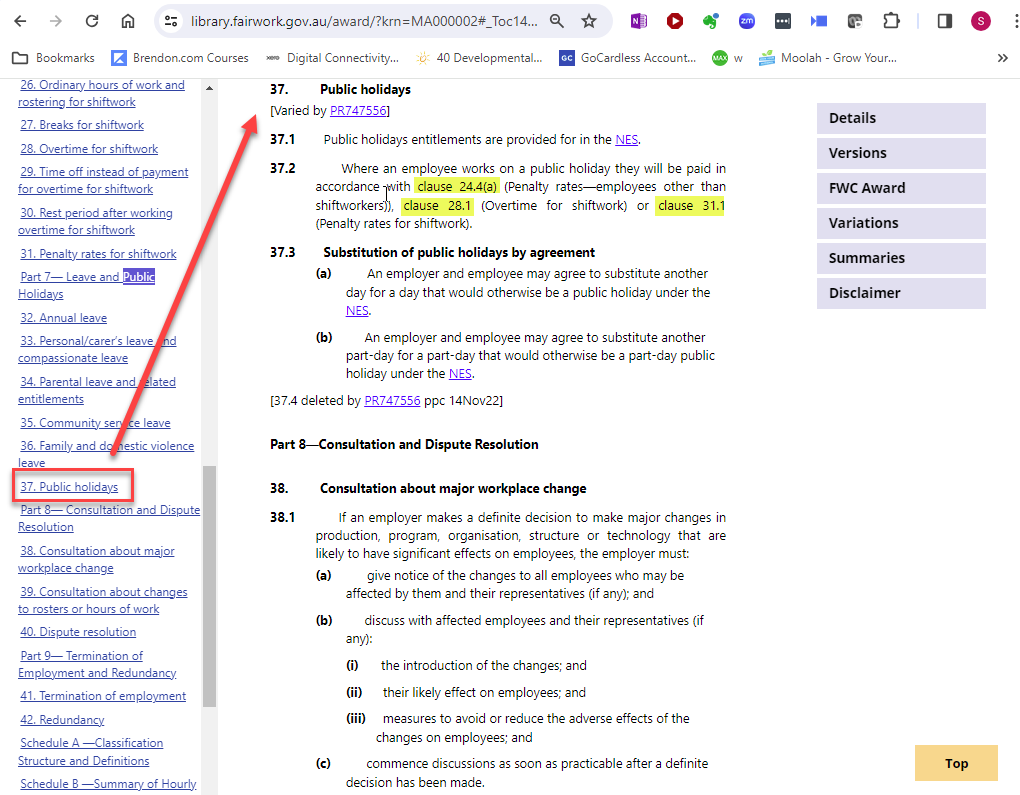

When I click on the Public Holidays section, I will be taken to this area in the Award and can read through the requirements. I have highlighted the provisions in section 37.2 where it says that where an employee works on a public holiday that they will be paid penalty rates in accordance with different clauses of the award depending upon the employee’s employment terms.

.

You will also see that 37.3 allows for substitution of public holidays.

If your employee does work, then you would then want to go and take a look at the relevant clause relating to penalty rates and how they might apply. We’ll use the example of a normal employee who doesn’t do shiftwork. We go to look at clause 24.4(a) where we see that an employer must pay an employee 250% of the minimum hourly rate for hours worked on the public holiday.

There can potentially be interaction with other areas of the Award as well relating to Ordinary hours of work and rostering too, so always ensure that you are across the Award that you’re applying so that you know how it works for you.

Wrapping It Up

Employing people is an area heavily government by legislation and lots of red tape and as a business owner it is your responsibility to be across all of the requirements. This includes payment obligations for public holidays – whether your team members work them or not.

Here at the Bee Group we cannot give you advice around the selection of an Award but we can help you navigate the obligations that arise from them.

Because of the consequences of getting it wrong we generally will recommend that you engage with an employer group or a legal practitioner who is specialised in employment matters just to make sure that everything is compliant and above board.

If you would like specific advice tailored to your business and situation, Bee Group Accountants offers affordable service packages where you can work with us one-on-one to help you get your business where you want it to be. Book your Discovery Call to find out more.

Disclaimer: This is general information only and is not advice of any sort. Please refer to our Terms and Conditions if in any doubt. No warranty or representation is provided by Bee Group Accountants as to the accuracy, currency or completeness of the information contained in this blog. Readers of this blog should not act or refrain from acting in reliance upon any information contained herein and must always obtain appropriate taxation and / or other advice as may be appropriate having regard to their particular circumstances.